In Game Theory, a zero-sum game is a situation where someone’s gain is someone else’s loss: if you give a larger piece of the cake to one participant, the amount of cake available to others will be reduced accordingly.

Often, when we discuss the benefits of optimising mass transportation schedules, the resulting cost savings – whether five or ten percent – sound impressive, yet some of our audiences may think they only represent a marginal improvement of their business. In another post, we will argue that all savings matter, since they can deployed into a more frequent service, better on-time performance or better shifts for drivers. In this post we’ll discuss how optimisation helps win bids for new transportation business, and how optimisation outcomes for tenders are a zero-sum game.

1.Even 0.7% savings count. A lot.

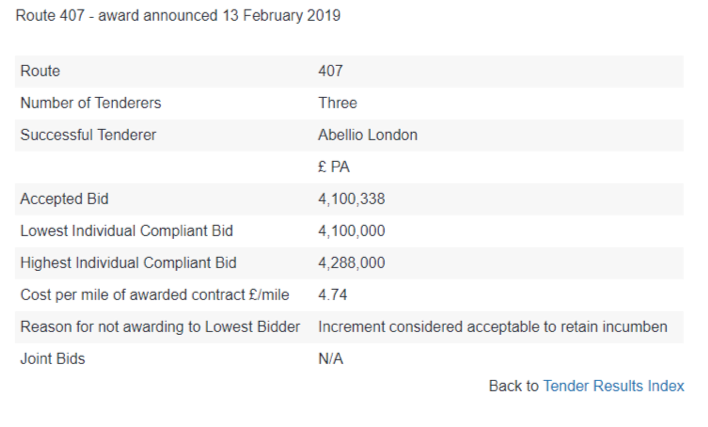

Transport for London publishes the results of its bus tenders. It also publishes the reasons for each win or loss. You can check the data here. Looking at the data, it is immediately apparent that bus tenders in London are extremely competitive, with a 5% difference between the highest and lowest bids in most tenders. As a result, forgoing an opportunity to reduce operating expenses by 5% or less can mean losing a tender, with zero-sum implications – another operator will be getting that business. Let’s look at the following example: a tender for route 407, which was awarded on February 13th. The highest bid was £ 4,288,000 and the lowest bid was £ 4,100,000. The difference between the two bids? 4.4 %.

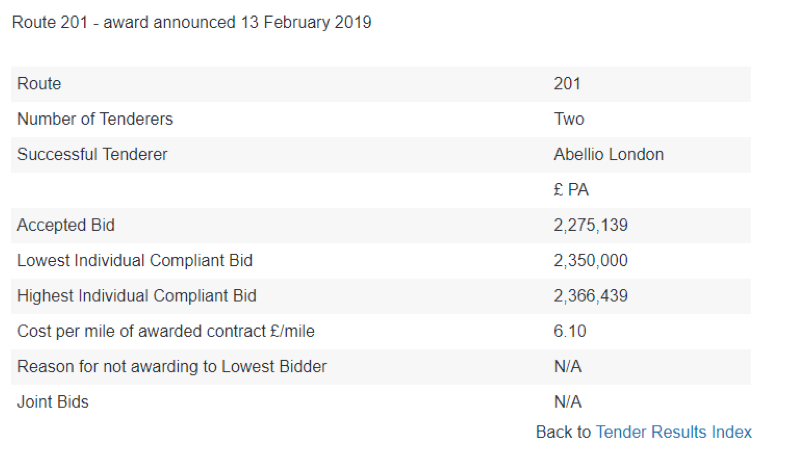

Sometimes the difference between the highest and lowest bids is much much smaller. A tender for Route 201 was awarded to the lowest bidder. The highest bid was just 0.7% higher. That definitely is a zero sum game. While using technology to reduce costs by 1% may seem a small difference, it can mean a 100% increase in chances to win the tender – from 0 to 100.

2. The more the merrier

One of the complaints we hear most from public transportation operators is that applying for tenders (or making any service change, small or large), takes too long. Sometimes it takes so long that companies don’t make as many bids as they would like, since bidding takes up so much scheduling work that they don’t have enough scheduling labor, forcing them to prioritise and submit less bids.

One of the main reasons behind the inability to make the bidding process faster is that legacy planning and scheduling software isn’t accurate and requires manual work, hurting optimisation as well as resulting in longer bidding times. Next generation software, such as Optibus’, with quick optimisation runs and the ability to quickly configure and express all rules and preferences (including relief vehicles, different work rules for different drivers etc), is built to support more bids and better business agility.

3.Validating results

Next generation software also includes various validations, alerting users to cases where the bids contain errors that may potentially result in heavy losses. The core business KPIs for any bid are presented clearly, in monetary terms, as well as key efficiency metrics. As a result, bids can be created simply – resulting in many scenarios, and these scenarios can be compared according to the KPIs, creating a clear way to identify optimal scenarios.

4.Is there a catch?

Sometimes we get asked by operators whether it’s worthwhile to join the scheduling optimization “arms race”. The argument is that what’s the point of using next-generation scheduling software if everyone is using it and bids are getting more competitive. Looking at the two examples above provides an immediate answer – one reason to modernize the software infrastructure for bidding is gaining that 0.7 % competitive advantage. After all, this is a zero-sum game.

Despite the fear that all bidders using the same platform will end up with the same identical bid, this isn’t true, as in many cases there are different underlying business and operational limitations, producing different bid results for different operators. This can even help operators zone in on the scheduling habits or underlying issues (such as depot location, for instance) that are preventing them from making optimal bids.

But there is a better answer: mass transportation needs to modernise its underlying software infrastructure, which is way behind what new mobility operators are using. It needs to be cloud-based, based on data and able interface quickly with future platforms, such as MaaS platforms. Regardless of tenders, new software is becoming key to the future of the mass transportation business.